What's Up Real Estate - October 6th 23 Report

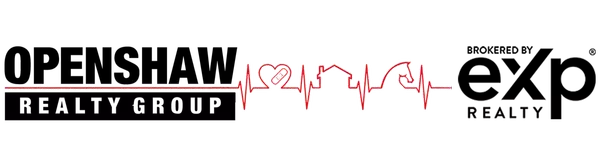

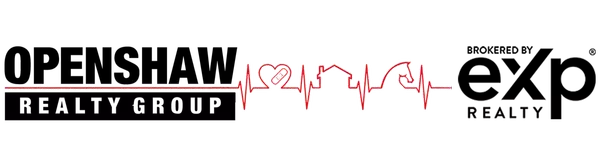

Real Estate News in Brief The trend has not been a homebuyer’s friend, as mortgage rates hit another new high, while home prices continued to rise across the country. It’s jobs week again, with conflicting evidence from the JOLTS survey for August (beat = bad for bond prices and mortgage rates) and ADP’s employment report for September (miss = good for bond prices and mortgage rates). But these are mere preludes to the very important Bureau of Labor Statistics (“BLS”) jobs numbers which will come out this (Friday) morning. Reminder: JOLTS is an acronym for Job Openings and Labor Turnover Summary. It also comes from the BLS. Job Openings are open positions — basically, ads for jobs. They aren’t official jobs (employment) until those positions get filled. Still, a rising number of job openings definitely indicates stronger hiring demand on the part of employers. (-) The August JOLTS report showed a chunky 8% MoM increase in job openings, to 9.6 million. That was much higher than expected, and snapped three months of declines. What is interesting about this is that the “hires rate” of 3.7% and the “separations rate” (quits + layoffs) of 3.6% were both: 1) unchanged MoM, and 2) very similar. So while job openings may have jumped in August, we know that actual net jobs growth didn’t. [BLS] (+) This ties in nicely with ADP’s September (note the month) employment report, which saw a net increase in private employment of just 89,000. Remember, these are actual jobs. That was both: 1) lower than expected, and 2) the smallest increase in private employment since early 2021. So how does ADP’s number usually compare with the soon-to-be-released BLS number? While they certainly trend in the same direction, the month to month relationship is volatile. [ADP] BLS monthly data will come out later this morning. Average 30-year mortgage rates continued to set new two-decade highs, hitting 7.74% on Thursday. The latest move was driven by: 1) the JOLTs beat, and 2) unhelpful commentary from several Fed members. [Mortgage News Daily] The Mortgage Bankers Association reported that its Purchase Index (a measure of new purchase mortgage applications) fell 6% WoW and 22% YoY to a level not seen since 1996. In their own words, “The rapid rise in rates pushed an increasing number of potential homebuyers out of the market.” Not surprisingly, interest in ARMs (adjustable rate mortgages) is rising, as buyers look for any opportunity to get their mortgage rate down. [MBA] We got the August home price growth numbers from Black Knight (+0.7% MoM) and CoreLogic (+0.3% MoM). Year-to-date, both indices are up 5.0–5.5%. At this pace, home prices would rise 7.5–8.0% YoY in 2023. On a $400,000 home, that’s $30,000–36,000 in appreciation. [Black Knight, CoreLogic] Rental rates usually fall in September. But this September, they dropped 0.5% MoM, the largest drop in many years. As a result, national rental rates are now down 1.2% YoY. And it’s widespread: rents are down YoY in 71 of the 100 largest cities. [ApartmentList] Mortgage Market If I sound like a broken record, it’s only because we keep breaking records — the wrong kind. The 10-year treasury yield briefly touched 4.8% this week, moving up aggressively in response to the JOLTs “beat”, before calming down on the ADP “miss.” Q: What’s driving this strong upward trend in yields? Is it the ongoing ‘higher for longer’ commentary from Fed members? The quantitative tightening going on behind the scenes? The jobs data? A: All of the above. They Said It “This cooldown [in rental rates] is widespread; rents fell month-over-month in September in 85 of the nation’s 100 largest cities, and thanks to sluggish rent growth over the past 12 months, prices are down year-over-year in 71 of these 100 cities. Rent swings are largely driven by the balance between the number of vacant apartments available and the number of renters looking to move into them. A massive shortage of vacant units helped drive tremendous rent growth in 2021 and 2022, and today the opposite is true.” — Apartment List September Rental Report

Read More

Unveiling the Perfect Home Finder Program: Your Dream Home Awaits in North Texas!

Unveiling the Perfect Home Finder Program: Your Dream Home Awaits in North Texas! Ever thought finding your dream home in North Texas was a bit like chasing shadows? Think again! The fantastic Openshaw Realty Group is thrilled to introduce the Perfect Home Finder Program, changing the way future homebuyers uncover their dream abodes. WEATHERFORD, Texas & FORT WORTH, Texas - Aug. 28, 2023 - PRLog -- Working with lots of clever home hunters, The Openshaw Realty Group has uncovered a brilliant secret – many folks are using the wrong map to hunt for homes, ending up with houses that are "almost there" but not quite perfect.The Perfect Home Finder Program is like a treasure hunt designed to fix this. Here's the scoop: you tell us exactly what you want in a home, and we take on the challenge of finding homes that match your wishes perfectly. And guess what? These homes are owned by sellers who are super eager to make a deal!All through this month, The Openshaw Realty Group is offering the Perfect Home Finder Program for free, just for folks in our local area. It's your chance to explore potential homes without any strings attached – no pressure to make any decisions!This amazing service is here to unveil your Dream Home, even if it's hiding from the usual market. Imagine having a selection of homes across North Texas (Tarrant, Parker, Hood, Wise, Palo Pinto & Young Counties) that fit your dreams like a glove."We're all about making the journey to your dream home a happy one, not a tough challenge," says Kirstine Openshaw, CEO & Realtor of The Openshaw Realty Group. "Our Perfect Home Finder Program is here to make homebuying exciting and easy."Don't let your dream home stay a daydream. Jump on this super opportunity and get in touch with The Openshaw Realty Group today. Uncover homes that match your dreams by simply by clicking hereFor media inquiries, please contact:Kirstine Openshaw, CEO & Realtor of The Openshaw Realty Group Team@OpenshawRealty.com 940-372-0044About The Openshaw Realty Group: The Openshaw Realty Group is a dedicated team of real estate experts committed to providing innovative and personalized solutions to homebuyers and sellers in North Texas. With a passion for turning dreams into reality, The Openshaw Realty Group goes the extra mile to ensure a seamless and enjoyable real estate experience for their clients. ContactThe Openshaw Realty Group at EXP Realty, LLC 940-372-0044

Read More

Steps to Successfully Sell a House

Selling a home involves several steps to ensure a successful and smooth transaction. Here's a general overview of how to sell a home: Choose a Realtor: Select a reputable real estate agent who has experience selling homes in your area. They can provide valuable guidance, market expertise, and help you navigate the selling process. Preparation: Prepare your home for sale by cleaning, decluttering, and making necessary repairs. Consider staging your home to make it more appealing to potential buyers. Determine the Listing Price: Your realtor will help you determine the appropriate listing price for your home based on the local real estate market, comparable properties (comps), and the condition of your home. Market Your Home: Your realtor will create a listing for your home, including professional photographs and a detailed description. The listing will be advertised on various platforms, both online and offline. Showings: Potential buyers will request showings to view your home. Make your home as accessible as possible during this phase to accommodate their schedules. Receive Offers: Once an interested buyer is found, they will submit an offer. The offer will include the proposed purchase price, contingencies (such as inspections and financing), and any special terms. Negotiate: You and the buyer may go through a negotiation process to agree on the final terms of the sale. This can include price adjustments, repairs, and other considerations. Accept an Offer: Once you and the buyer reach an agreement, you'll accept the offer and the process will move forward. Buyer's Due Diligence: The buyer will typically conduct inspections and possibly an appraisal to ensure the property's condition and value align with the purchase price. Contingency Period: Depending on the contract, the buyer may have certain contingencies that need to be satisfied, such as inspection repairs, securing financing, or reviewing documents. Complete Repairs and Inspections: If repairs are agreed upon, ensure they are completed within the specified timeframe. Appraisal: The buyer's lender will order an appraisal to confirm the value of the property. If the appraisal comes in below the purchase price, renegotiations may be necessary. Finalize Documents: Work with your realtor and legal professionals to gather and prepare all necessary documents for the closing process. Closing: The closing is the final step where ownership of the property is officially transferred to the buyer. Both parties will sign various documents, and you'll receive the proceeds from the sale. Move Out: Once the sale is complete, you'll need to vacate the property and ensure it's in the agreed-upon condition. Selling a home can be complex, and the specific steps may vary based on local regulations and market conditions. It's essential to work closely with your realtor and potentially legal professionals to navigate the process effectively.

Read More

Categories

Recent Posts