What's Up Real Estate - October 6th 23 Report

Real Estate News in Brief

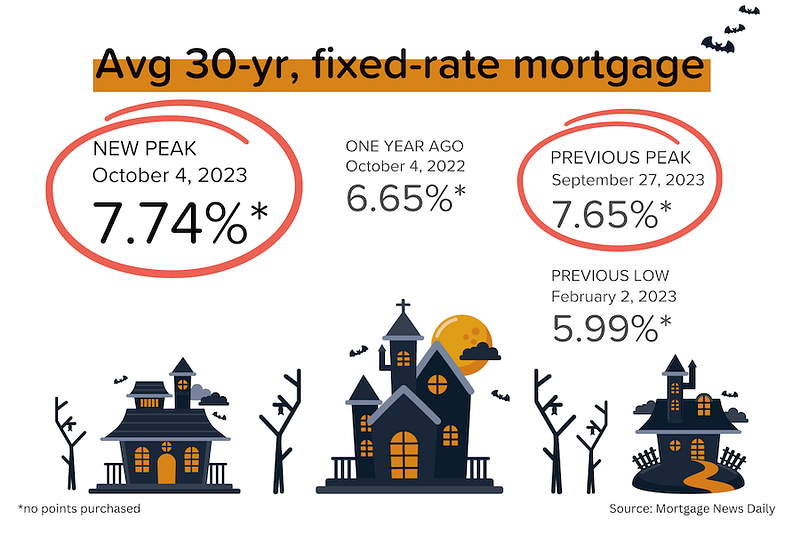

The trend has not been a homebuyer’s friend, as mortgage rates hit another new high, while home prices continued to rise across the country.

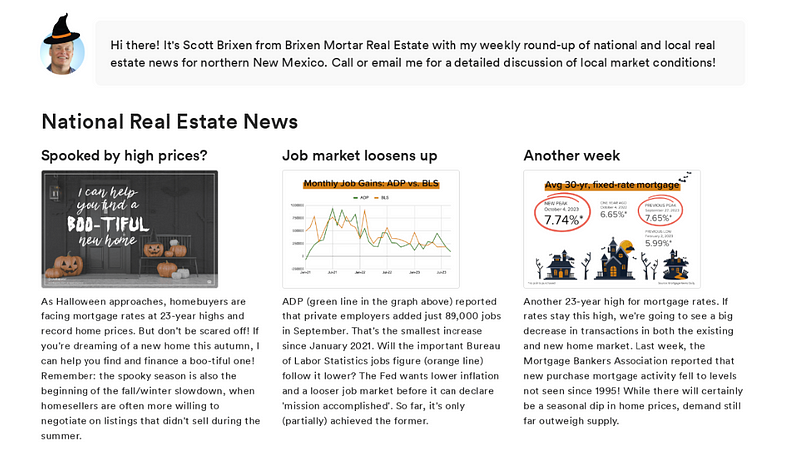

It’s jobs week again, with conflicting evidence from the JOLTS survey for August (beat = bad for bond prices and mortgage rates) and ADP’s employment report for September (miss = good for bond prices and mortgage rates). But these are mere preludes to the very important Bureau of Labor Statistics (“BLS”) jobs numbers which will come out this (Friday) morning.

Reminder: JOLTS is an acronym for Job Openings and Labor Turnover Summary. It also comes from the BLS. Job Openings are open positions — basically, ads for jobs. They aren’t official jobs (employment) until those positions get filled. Still, a rising number of job openings definitely indicates stronger hiring demand on the part of employers.

(-) The August JOLTS report showed a chunky 8% MoM increase in job openings, to 9.6 million. That was much higher than expected, and snapped three months of declines. What is interesting about this is that the “hires rate” of 3.7% and the “separations rate” (quits + layoffs) of 3.6% were both: 1) unchanged MoM, and 2) very similar. So while job openings may have jumped in August, we know that actual net jobs growth didn’t. [BLS]

(+) This ties in nicely with ADP’s September (note the month) employment report, which saw a net increase in private employment of just 89,000. Remember, these are actual jobs. That was both: 1) lower than expected, and 2) the smallest increase in private employment since early 2021. So how does ADP’s number usually compare with the soon-to-be-released BLS number? While they certainly trend in the same direction, the month to month relationship is volatile. [ADP]

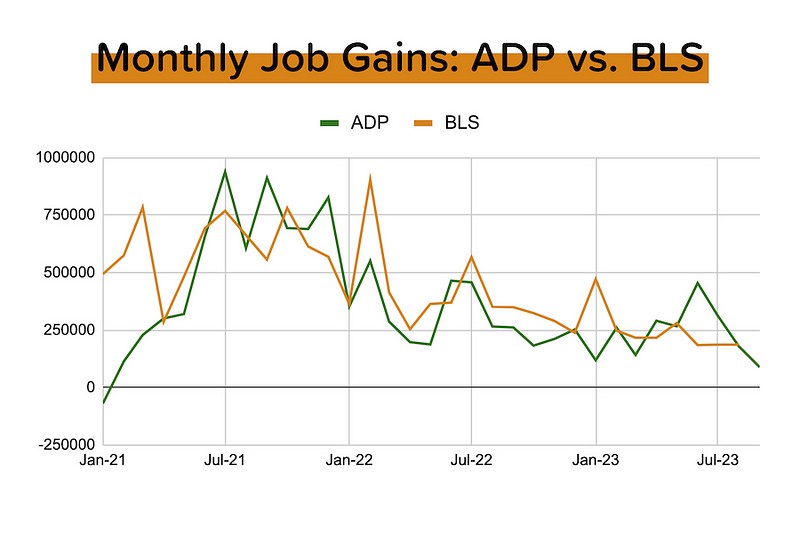

Average 30-year mortgage rates continued to set new two-decade highs, hitting 7.74% on Thursday. The latest move was driven by: 1) the JOLTs beat, and 2) unhelpful commentary from several Fed members. [Mortgage News Daily]

The Mortgage Bankers Association reported that its Purchase Index (a measure of new purchase mortgage applications) fell 6% WoW and 22% YoY to a level not seen since 1996. In their own words, “The rapid rise in rates pushed an increasing number of potential homebuyers out of the market.” Not surprisingly, interest in ARMs (adjustable rate mortgages) is rising, as buyers look for any opportunity to get their mortgage rate down. [MBA]

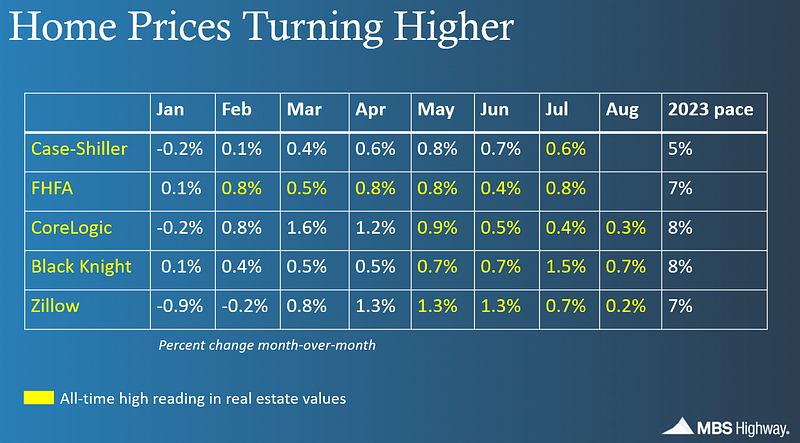

We got the August home price growth numbers from Black Knight (+0.7% MoM) and CoreLogic (+0.3% MoM). Year-to-date, both indices are up 5.0–5.5%. At this pace, home prices would rise 7.5–8.0% YoY in 2023. On a $400,000 home, that’s $30,000–36,000 in appreciation. [Black Knight, CoreLogic]

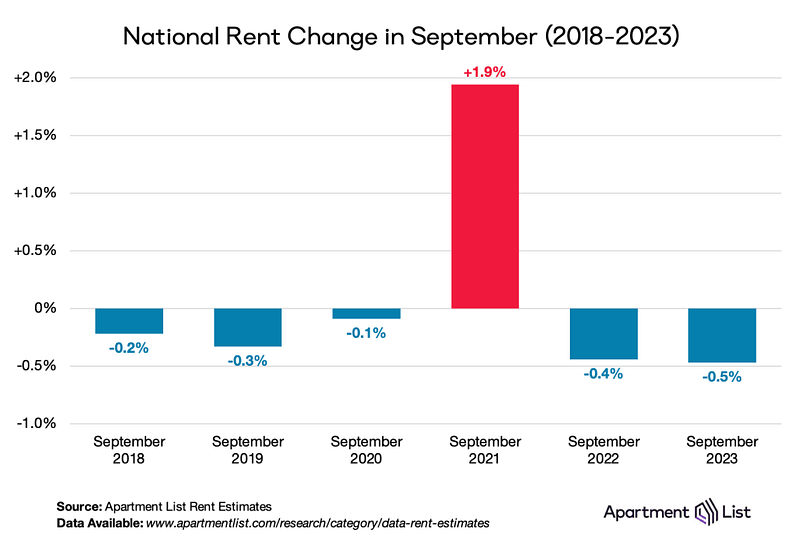

Rental rates usually fall in September. But this September, they dropped 0.5% MoM, the largest drop in many years. As a result, national rental rates are now down 1.2% YoY. And it’s widespread: rents are down YoY in 71 of the 100 largest cities. [ApartmentList]

Mortgage Market

If I sound like a broken record, it’s only because we keep breaking records — the wrong kind. The 10-year treasury yield briefly touched 4.8% this week, moving up aggressively in response to the JOLTs “beat”, before calming down on the ADP “miss.” Q: What’s driving this strong upward trend in yields? Is it the ongoing ‘higher for longer’ commentary from Fed members? The quantitative tightening going on behind the scenes? The jobs data? A: All of the above.

They Said It

“This cooldown [in rental rates] is widespread; rents fell month-over-month in September in 85 of the nation’s 100 largest cities, and thanks to sluggish rent growth over the past 12 months, prices are down year-over-year in 71 of these 100 cities.

Rent swings are largely driven by the balance between the number of vacant apartments available and the number of renters looking to move into them. A massive shortage of vacant units helped drive tremendous rent growth in 2021 and 2022, and today the opposite is true.” — Apartment List September Rental Report

Categories

Recent Posts